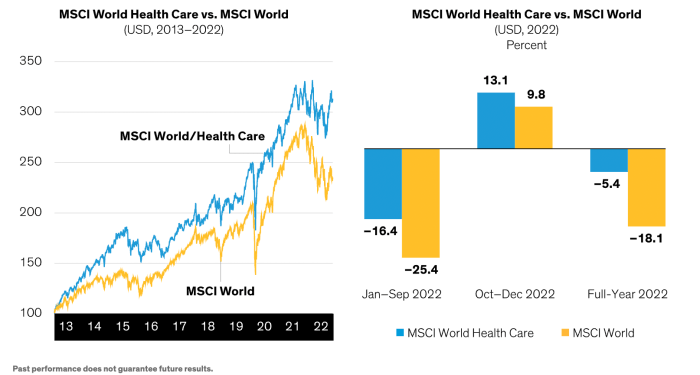

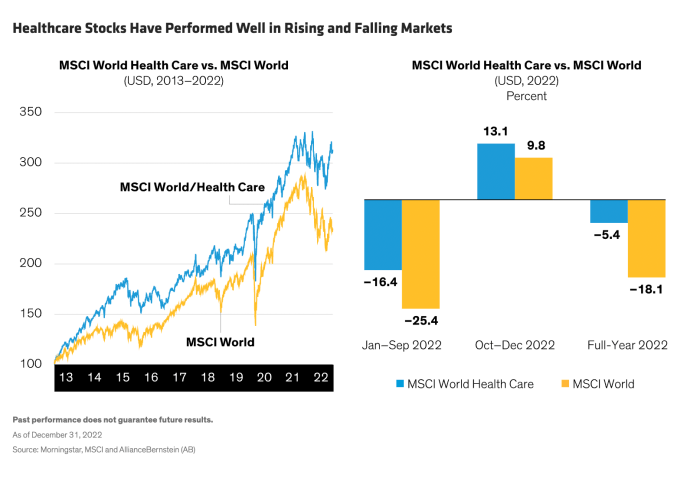

Exploring the factors that drive share price volatility in healthcare stocks, this introduction sets the stage for an insightful discussion that delves into the complexities of the market.

It will provide a comprehensive overview of the key influencers affecting the stock prices in the healthcare sector.

Factors Affecting Healthcare Stock Price Volatility

Healthcare stock prices are influenced by a variety of factors that can cause volatility in the market. Understanding these key factors is essential for investors looking to navigate this sector effectively.

Key Economic Indicators Impacting Healthcare Stock Prices

- Economic indicators such as interest rates, inflation rates, and GDP growth can have a significant impact on healthcare stock prices.

- For example, a rise in interest rates may lead to higher borrowing costs for healthcare companies, affecting their profitability and ultimately their stock prices.

- Similarly, changes in inflation rates can influence consumer spending on healthcare services and products, directly impacting the financial performance of healthcare companies.

Regulatory Changes and Healthcare Stock Price Volatility

- Regulatory changes, such as new healthcare laws or policies, can create uncertainty in the market and cause fluctuations in healthcare stock prices.

- For instance, the implementation of new regulations that impact reimbursement rates for healthcare services can affect the revenue and profitability of healthcare companies, leading to stock price volatility.

- Investors closely monitor regulatory developments to assess the potential impact on healthcare stocks and adjust their investment strategies accordingly.

Company-Specific Events and Share Price Volatility

- Company-specific events, such as FDA approvals, clinical trial results, or mergers and acquisitions, can have a direct impact on the stock prices of healthcare companies.

- Positive news, like successful drug trials or strategic partnerships, can lead to a surge in stock prices, while negative events, such as product recalls or legal disputes, can cause significant drops in share prices.

- It is crucial for investors to stay informed about these company-specific events and their potential implications on the stock market to make informed decisions.

Market Sentiment and Share Price Volatility

Market sentiment plays a crucial role in influencing the volatility of healthcare stock prices. The perception and emotions of investors towards a particular healthcare company can lead to fluctuations in its stock price.

Impact of Positive versus Negative News

Positive news such as successful clinical trials, FDA approvals, or strong financial results can boost investor confidence and lead to an increase in share prices. On the other hand, negative news like drug recalls, regulatory issues, or disappointing earnings reports can trigger a sell-off, causing the stock price to drop significantly.

- Positive News:

- Successful clinical trials

- FDA approvals

- Strong financial results

- Negative News:

- Drug recalls

- Regulatory issues

- Disappointing earnings reports

Investor Perception

Investor perception, which is influenced by various factors such as company reputation, industry trends, and macroeconomic conditions, can also impact healthcare stock price volatility. If investors believe that a healthcare company has a promising future due to innovative products or strategic partnerships, they may drive up the stock price.

Conversely, concerns about competition, litigation, or changes in healthcare policies can lead to a decrease in share prices.

- Factors Affecting Investor Perception:

- Company reputation

- Industry trends

- Macroeconomic conditions

- Innovative products

- Competition

- Litigation

- Healthcare policies

Competitive Landscape and Share Price Volatility

In the healthcare industry, competition plays a significant role in influencing stock price volatility. The level of competition within the market can impact investors' perceptions of a company's future performance, leading to fluctuations in share prices.

Market Positioning Strategies and Share Price Volatility

Market positioning strategies adopted by healthcare companies can greatly influence share price volatility. For example, companies that successfully differentiate themselves from competitors through innovative products or services may experience less volatility in their stock prices. Conversely, companies that fail to effectively position themselves in the market may face greater fluctuations in share prices as investors react to uncertainties surrounding their competitive advantage.

- One example of a successful market positioning strategy is focusing on niche healthcare markets where there is less competition. By targeting specific patient populations or therapeutic areas, companies can create a unique value proposition that sets them apart from competitors and reduces the impact of market rivalry on share price volatility.

- On the other hand, companies that engage in price wars or engage in cut-throat competition may experience higher levels of share price volatility. Investors may view such companies as being at a higher risk of losing market share or facing margin pressures, leading to fluctuations in stock prices.

Mergers and Acquisitions Impact on Share Price Volatility

Mergers and acquisitions (M&A) are common occurrences in the healthcare industry and can have a significant impact on share price volatility. When companies merge or acquire other entities, investors may react positively or negatively depending on the perceived synergies, potential cost savings, or growth opportunities.

M&A activities can lead to increased volatility in healthcare stocks as investors assess the strategic rationale behind the deal, integration challenges, and the potential impact on the companies' financial performance.

- Successful M&A transactions that are well-received by the market may lead to a temporary increase in share price volatility as investors adjust their expectations and pricing models to account for the new entity's expanded market presence and growth prospects.

- Conversely, failed or poorly executed M&A deals can result in sharp declines in share prices as investors lose confidence in the companies' ability to deliver value from the transaction, leading to heightened volatility in stock prices.

Technological Advancements and Share Price Volatility

Technological advancements play a crucial role in shaping the landscape of healthcare stocks. These advancements can lead to fluctuations in share prices due to the impact they have on a company's competitive edge, market potential, and investor sentiment.

Impact of New Healthcare Technologies on Investor Confidence

New healthcare technologies have the potential to significantly boost investor confidence in a company. For instance, the development of innovative medical devices, breakthrough treatments, or digital health solutions can attract investors looking for growth opportunities in the healthcare sector. On the other hand, companies that fail to keep up with technological advancements may see a decline in investor confidence, leading to share price volatility.

- Investors often view companies that are at the forefront of technological innovation as more likely to succeed in the long term, leading to higher stock prices.

- Conversely, companies that lag behind in adopting new technologies may face challenges in remaining competitive, resulting in lower share prices.

Examples of Healthcare Companies Affected by Technological Advancements

One notable example is Intuitive Surgical, the maker of the da Vinci surgical system. The company's stock price has experienced significant volatility in response to advancements in robotic surgery technology.

Another example is Teladoc Health, a telemedicine company that saw a surge in its stock price following the increased adoption of virtual care solutions during the COVID-19 pandemic.

Outcome Summary

In conclusion, the discussion on What Influences Share Price Volatility in Healthcare Stocks sheds light on the multifaceted nature of this industry and the various factors that can impact stock prices.

Query Resolution

What economic indicators impact healthcare stock prices?

Economic indicators such as GDP growth, interest rates, and healthcare spending can influence healthcare stock prices.

How does market sentiment affect share price volatility in healthcare stocks?

Market sentiment can lead to fluctuations based on investor perception and emotions rather than fundamental analysis.

What role do mergers and acquisitions play in influencing volatility in healthcare stocks?

Mergers and acquisitions can impact stock prices by changing market dynamics and altering competitive landscapes.