Starting off with Should You Diversify with Auto Stocks Like GM?, this introductory paragraph aims to grab the readers' attention and provide a brief overview of the topic in a engaging manner.

The following paragraph will delve into the specifics and details of the topic at hand.

Overview of Auto Stocks and Diversification

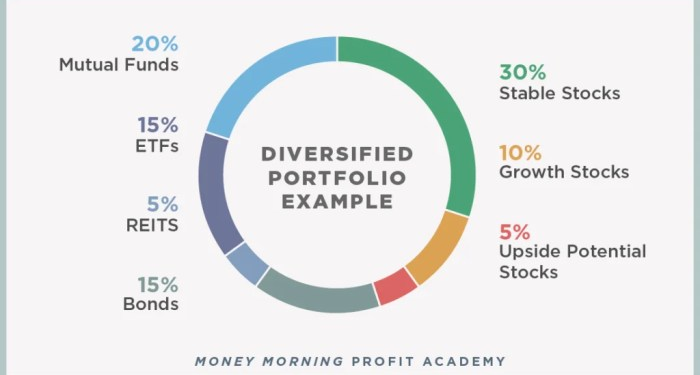

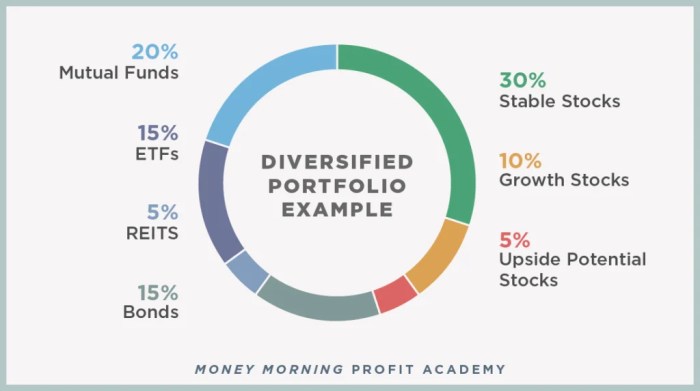

Auto stocks refer to stocks of companies that are involved in the manufacturing, distribution, and sale of automobiles and related products. Diversification in investing is the strategy of spreading your investments across different assets to reduce risk.

Popular Auto Stocks for Diversification

When considering diversifying with auto stocks, there are several popular options besides GM that investors can explore:

- Ford Motor Company (F)

- Tesla, Inc. (TSLA)

- Honda Motor Co., Ltd. (HMC)

- Toyota Motor Corporation (TM)

Benefits of Diversifying with Auto Stocks

Diversifying with auto stocks can offer various benefits to investors, such as:

- Reduced Risk:By investing in multiple auto stocks, you can mitigate the impact of poor performance from a single company.

- Exposure to Different Markets:Each auto company operates in different regions and markets, providing exposure to diverse economic conditions.

- Capitalizing on Industry Growth:Investing in a mix of auto stocks allows you to benefit from the overall growth potential of the automotive industry.

- Opportunity for Returns:Diversification can potentially lead to higher returns by capturing the growth of multiple companies within the sector.

Performance of GM Stock

When it comes to analyzing the historical performance of GM stock, it is essential to look at how the company has fared over the years in the stock market. Comparing GM's stock performance with other auto companies can provide valuable insights into the trends and dynamics of the industry.

Various factors influence the stock performance of GM, ranging from internal company decisions to external market conditions.

Historical Performance of GM Stock

GM, or General Motors, has had a tumultuous history in the stock market. From its peak before the financial crisis to its bankruptcy filing in 2009 and subsequent recovery, GM stock has experienced significant ups and downs. Investors who held onto GM stock through these turbulent times have seen varying returns depending on their entry and exit points.

Comparison with Other Auto Companies

When comparing GM's stock performance with other auto companies such as Ford, Tesla, Toyota, and Volkswagen, GM's stock may have shown different levels of volatility and growth. Factors such as market share, innovation, management decisions, and global economic conditions can all impact how GM's stock stacks up against its competitors.

Factors Influencing GM's Stock Performance

Several factors can influence the stock performance of GM, including quarterly earnings reports, new product launches, changes in consumer demand, regulatory developments, macroeconomic trends, and global supply chain disruptions. Investors need to consider these factors and conduct thorough research before deciding whether to invest in GM stock.

Risks and Challenges of Investing in Auto Stocks

Investing in auto stocks like GM comes with its own set of risks and challenges that investors need to consider. These risks can impact the performance and profitability of the investment, making it crucial to be aware of potential pitfalls and uncertainties.

Market Volatility

Market volatility is a significant risk when investing in auto stocks. Fluctuations in the market can lead to sudden changes in stock prices, impacting the value of your investment. Factors such as economic conditions, consumer demand, and industry trends can all contribute to market volatility.

Regulatory Changes

Auto stocks are highly regulated, with changes in regulations having a direct impact on the industry. Shifts in emissions standards, safety regulations, or trade policies can affect the operations and profitability of auto companies like GM. Investors need to stay informed about regulatory changes and their potential implications.

Competition and Innovation

The auto industry is highly competitive, with companies constantly innovating to stay ahead. Failure to keep up with technological advancements or shifts in consumer preferences can result in a decline in market share and profitability. Investors should consider the competitive landscape when investing in auto stocks.

Global Economic Conditions

Auto stocks are also susceptible to global economic conditions. Factors such as interest rates, exchange rates, and geopolitical events can impact the financial performance of auto companies. Investors need to assess the potential impact of global economic conditions on their investment.

Strategies for Mitigating Risks

To mitigate the risks associated with investing in auto stocks, investors can employ various strategies. Diversification, thorough research, and staying informed about industry trends and developments can help investors make informed decisions. Setting realistic expectations and having a long-term investment horizon can also help manage risks effectively.

GM's Market Position and Future Outlook

GM, also known as General Motors, holds a significant position in the auto industry as one of the largest automakers globally. With a rich history and a diverse portfolio of brands under its umbrella, GM has established itself as a key player in the market.

Current Market Position

GM remains a formidable force in the auto industry, with a strong presence in key markets around the world. The company's focus on innovation, technology, and sustainability has helped it stay competitive amidst changing consumer preferences and industry trends.

Future Prospects and Growth Potential

Looking ahead, GM's future outlook appears promising, especially with its commitment to electric vehicles (EVs) and autonomous driving technology. The company's investments in these areas signal a strategic shift towards a more sustainable and tech-driven future, positioning GM well for growth and success in the long run.

Recent Developments and Innovations

In recent years, GM has made significant strides in the EV space with the launch of models like the Chevy Bolt and the upcoming GMC Hummer EV. These initiatives showcase GM's dedication to advancing electric mobility and reducing its carbon footprint.

Additionally, the company's partnerships and collaborations in the autonomous vehicle sector highlight its efforts to stay at the forefront of innovation and technological advancements.

Ultimate Conclusion

Concluding with a captivating summary of the discussion, this paragraph wraps up the key points in an engaging way.

FAQ Summary

Should I consider diversifying with auto stocks like GM?

Yes, diversifying with auto stocks can help spread risk and potentially enhance returns in your investment portfolio.

What are some popular auto stocks besides GM for diversification?

Some other popular auto stocks for diversification include Ford, Tesla, Toyota, and Honda.

What are the risks associated with investing in auto stocks like GM?

Risks can include economic downturns affecting auto sales, regulatory changes impacting the industry, and company-specific issues like recalls or competition.

How can I mitigate risks when investing in auto stocks?

Strategies to mitigate risks include diversifying your investments across different industries, staying informed about market trends, and conducting thorough research on companies before investing.