Beginning with Shopify Capital Loan Explained: Pros, Cons & Best PracticesWhat Makes JEPI ETF a Top Pick for Conservative Investors?, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

In this article, we will delve into the intricacies of Shopify Capital loans and explore why JEPI ETF stands out as a top choice for conservative investors.

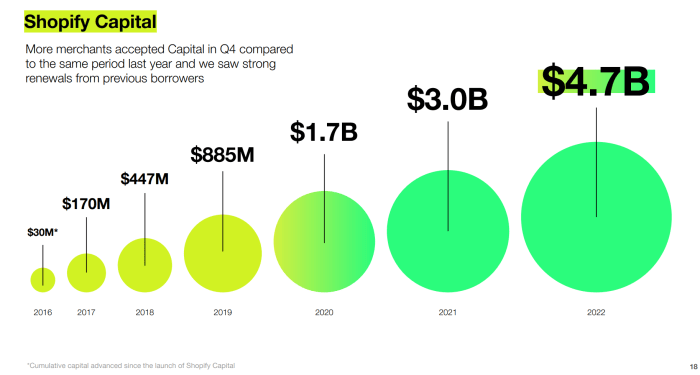

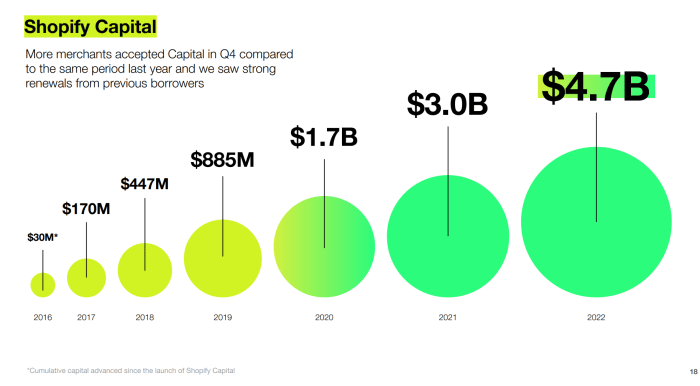

Shopify Capital Loan Explained

Shopify Capital loans are a type of financing offered by Shopify to eligible e-commerce businesses. These loans are designed to provide quick and easy access to funds to help merchants grow and expand their online stores.

Benefits of Shopify Capital Loans

- Quick access to funds: Shopify Capital loans offer a fast and streamlined application process, allowing businesses to access the funds they need without delay.

- No fixed monthly payments: Instead of fixed monthly payments, repayments are made through a percentage of daily sales, making it easier for businesses during slower months.

- No credit check: Shopify Capital loans do not require a credit check, making them accessible to businesses with varying credit histories.

Application Process and Eligibility Criteria

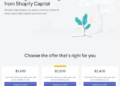

To apply for a Shopify Capital loan, merchants must meet certain eligibility criteria, such as having a minimum monthly revenue threshold and a history of consistent sales on their Shopify store. The application process typically involves a review of the business's sales history and overall performance on the platform.

Pros of Shopify Capital Loans

When it comes to financing options for businesses, Shopify Capital loans offer a range of benefits that make them a popular choice among entrepreneurs. From fast approval processes to flexible repayment terms, there are several advantages to choosing a Shopify Capital loan over traditional funding options.

Quick and Easy Application Process

- Shopify Capital loans have a streamlined application process, allowing businesses to access funding quickly and without the hassle of extensive paperwork.

- With minimal documentation requirements, businesses can get approved for a loan in a matter of days, providing them with the capital they need to grow their operations.

Flexible Repayment Terms

- Unlike traditional loans, Shopify Capital loans offer flexible repayment terms that are based on a percentage of your daily sales, making it easier to manage cash flow and avoid financial strain.

- This dynamic repayment structure means that businesses only pay back the loan when they make sales, providing a more sustainable way to repay the borrowed funds.

Competitive Interest Rates

- Shopify Capital loans come with competitive interest rates that are often lower than those offered by traditional lenders, saving businesses money in the long run.

- By taking advantage of these lower rates, businesses can invest in growth opportunities without the burden of high-interest payments.

Cons of Shopify Capital Loans

When considering Shopify Capital loans, it's important to be aware of the potential drawbacks and risks that come with this type of financing. While Shopify Capital loans offer many benefits, there are certain situations where they may not be the best option for a business.

Here are some cons to keep in mind:

1. Limited Loan Amounts

One of the drawbacks of Shopify Capital loans is that the loan amounts are typically smaller compared to traditional bank loans or other lending options. This limitation may not meet the financial needs of some businesses, especially those looking for larger capital injections.

2. Higher Fees and Interest Rates

Shopify Capital loans often come with higher fees and interest rates compared to other financing options. This can increase the overall cost of borrowing and impact the profitability of the business in the long run.

3. Repayment Structure

The repayment structure of Shopify Capital loans may not be flexible enough for some businesses. The automatic deduction of repayments from daily sales can put a strain on cash flow, especially during slow periods or seasonal fluctuations.

4. Limited Eligibility Criteria

Not all businesses may qualify for a Shopify Capital loan due to the specific eligibility criteria set by Shopify. This can limit access to this financing option for some businesses that do not meet the requirements.

5. Dependency on Shopify Ecosystem

By taking a Shopify Capital loan, businesses become more dependent on the Shopify platform. This can limit flexibility and may restrict the ability to explore other financing options or expand beyond the Shopify ecosystem.

Best Practices for Utilizing Shopify Capital Loans

When it comes to making the most of a Shopify Capital loan, there are several key strategies to keep in mind. By effectively managing the funds obtained through this financing option, you can maximize your return on investment and fuel the growth of your business.

Here are some best practices to consider:

Develop a Clear Plan for Fund Allocation

- Identify specific areas of your business that need financial support.

- Create a detailed budget outlining how you will allocate the funds.

- Prioritize investments that will generate the highest ROI.

Reinvest Profits to Accelerate Growth

- Consider using a portion of the funds to expand your product line or improve your marketing strategies.

- Reinvest profits back into the business to drive sustainable growth over time.

- Monitor the performance of your investments and make adjustments as needed.

Focus on Customer Acquisition and Retention

- Allocate funds towards acquiring new customers through targeted marketing campaigns.

- Invest in customer retention strategies to build long-term relationships and loyalty.

- Track customer acquisition costs and lifetime value to optimize your marketing efforts.

Utilize Data Analytics for Informed Decision-Making

- Use data analytics tools to track key performance indicators and measure the impact of your investments.

- Gain insights into customer behavior and preferences to tailor your strategies accordingly.

- Make data-driven decisions to optimize your business operations and drive growth.

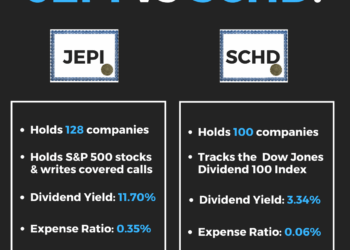

JEPI ETF as a Top Pick for Conservative Investors

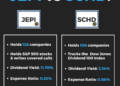

When it comes to conservative investing, the JEPI ETF stands out as a top pick for many investors looking for stability and consistent returns. Let's dive into the key features, investment strategy, and historical performance of the JEPI ETF.

Key Features and Objectives of JEPI ETF

The JEPI ETF, also known as the JPMorgan Equity Premium Income ETF, is designed to provide investors with income generation and capital appreciation by investing in a diversified portfolio of equity securities. It aims to deliver a premium above the S&P 500 Index through a combination of options strategies and dividend-paying stocks.

- Focus on income generation and capital appreciation

- Diversified portfolio of equity securities

- Utilizes options strategies and dividend-paying stocks

Investment Strategy for Conservative Investors

For conservative investors, the JEPI ETF employs a strategic approach that focuses on generating income while minimizing risk. The fund aims to provide a steady stream of income through dividends and options premiums, while also seeking to protect capital during market downturns.

- Emphasis on income generation with lower risk exposure

- Focus on dividend-paying stocks for stability

- Utilizes options strategies to enhance returns and manage risk

Historical Performance and Track Record

When compared to other conservative investment options, the JEPI ETF has demonstrated strong performance and a solid track record. Over the years, the fund has consistently delivered competitive returns while preserving capital during market volatility.

With a history of outperforming the S&P 500 Index and other conservative investments, JEPI ETF has proven to be a reliable choice for investors seeking a balance of income and stability.

- Competitive returns compared to benchmark indices

- Stable performance during market downturns

- Consistent income generation for investors

Benefits of Investing in JEPI ETF

Investing in JEPI ETF offers several advantages for conservative investors looking to diversify their portfolios and manage risks effectively. JEPI ETF is known for its stability and reliability, making it a top pick for those seeking a conservative approach to investing.

Advantages of Including JEPI ETF in a Conservative Investment Portfolio

- JEPI ETF provides exposure to a diversified portfolio of high-quality, investment-grade preferred securities, offering a steady stream of income for investors.

- It helps in reducing overall portfolio volatility by spreading investments across various sectors and companies, thus minimizing the impact of market fluctuations.

- With JEPI ETF, investors can benefit from the potential for capital appreciation while enjoying a relatively lower risk compared to individual stock investments.

Expert Opinions and Reviews on the Reliability and Stability of JEPI ETF

"JEPI ETF has been lauded by experts for its consistent performance and ability to generate stable returns over time, making it an attractive option for conservative investors."

Diversification Benefits and Risk Management Aspects of JEPI ETF for Conservative Investors

- JEPI ETF offers broad exposure to a range of preferred securities, helping investors spread their risk and avoid overexposure to any single asset or sector.

- By investing in JEPI ETF, conservative investors can achieve a balanced portfolio that provides a mix of income generation and potential for growth, all while maintaining a focus on risk management.

- The stability and reliability of JEPI ETF make it a valuable tool for conservative investors looking to achieve long-term financial goals while minimizing potential downside risks.

Considerations for Conservative Investors

When considering an investment in JEPI ETF, conservative investors should take into account several key factors to ensure it aligns with their financial goals and risk tolerance. JEPI ETF is designed to provide a balance between income generation and capital preservation, making it a suitable option for conservative investors looking for stable returns.

Comparing JEPI ETF with Similar Conservative Investment Options

- JEPI ETF vs. Bond Funds: While bond funds offer fixed income, JEPI ETF provides a diversified exposure to preferred securities, offering potentially higher yields.

- JEPI ETF vs. Money Market Funds: Money market funds provide stability and liquidity, but JEPI ETF offers the potential for higher returns over the long term.

- JEPI ETF vs. Dividend Stocks: Dividend stocks can be volatile, whereas JEPI ETF aims to provide consistent income through preferred securities.

Final Review

In conclusion, understanding the nuances of Shopify Capital loans and the appeal of JEPI ETF can empower investors to make informed decisions tailored to their financial goals and risk tolerance. Stay informed, invest wisely.

Detailed FAQs

What are Shopify Capital loans and how can they benefit e-commerce businesses?

Shopify Capital loans are financing options offered to Shopify merchants, providing quick access to capital for business growth. These loans can help businesses expand inventory, launch marketing campaigns, or improve infrastructure.

What are the advantages of choosing a Shopify Capital loan over traditional financing?

Shopify Capital loans offer streamlined application processes, competitive interest rates, and tailored repayment terms, making them attractive to e-commerce businesses seeking flexible funding options.

What is JEPI ETF and why is it considered a top pick for conservative investors?

JEPI ETF is an exchange-traded fund designed for conservative investors, focusing on stable returns and risk management. Its diversified portfolio and historical performance make it a reliable choice for those prioritizing capital preservation.