JEPI Stock vs. SCHD: Which Is Better for Passive Income? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

This engaging comparison dives into the world of passive income with a focus on JEPI Stock and SCHD, exploring their unique features and investment strategies that cater to investors seeking long-term financial growth.

Overview of JEPI Stock and SCHD

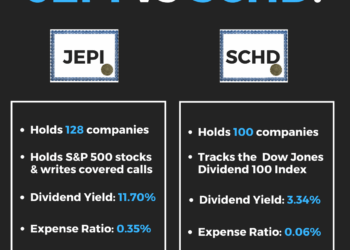

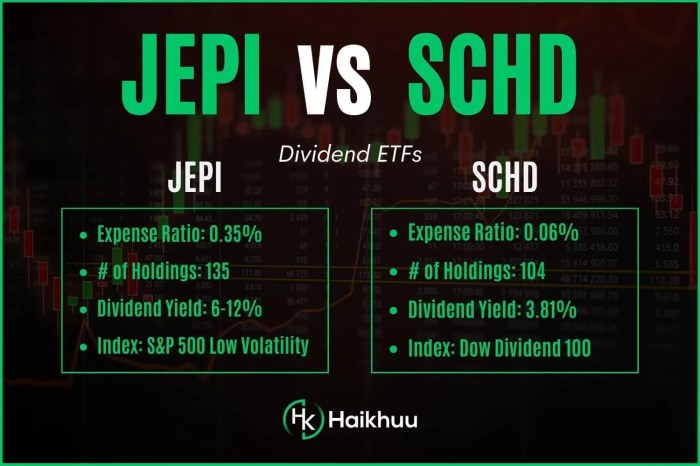

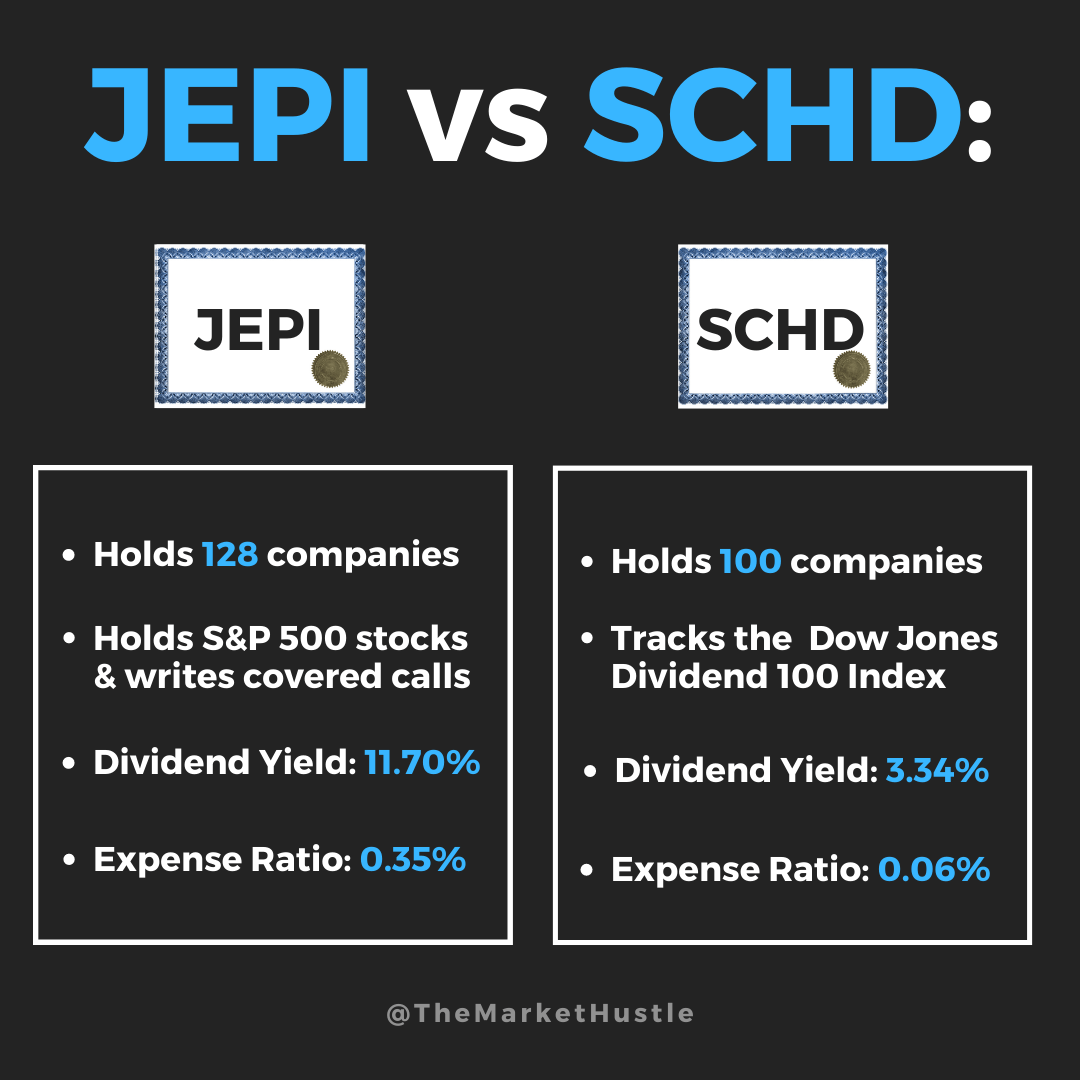

JEPI Stock and SCHD are two investment options that are popular among investors looking to generate passive income. Let's take a closer look at the main features and objectives of these two options, as well as the key differences between them.

JEPI Stock

JEPI Stock is an exchange-traded fund (ETF) that focuses on generating income through a diversified portfolio of high-quality dividend-paying stocks. The main objective of JEPI Stock is to provide investors with a steady stream of income while also offering the potential for capital appreciation over the long term.

- JEPI Stock invests in companies with a history of consistent dividend payments, aiming to provide a reliable source of passive income for investors.

- This ETF is designed to track the performance of an index composed of dividend-paying stocks, offering investors exposure to a broad range of sectors and industries.

- Investors looking for a passive income stream may find JEPI Stock to be a suitable option due to its focus on dividend-paying stocks and potential for long-term growth.

SCHD

SCHD, on the other hand, is another popular ETF that focuses on dividend growth investing. The primary goal of SCHD is to provide investors with a combination of current income and long-term capital appreciation by investing in companies with a history of increasing dividends.

- SCHD targets companies that have a track record of growing dividends, aiming to provide investors with a growing income stream over time.

- This ETF offers exposure to companies that have shown the ability to sustain and grow their dividends, making it an attractive option for investors seeking both income and potential capital appreciation.

- Investors interested in dividend growth investing may consider SCHD as a way to build a portfolio that can generate increasing income over the years.

Key Differences

- JEPI Stock focuses on high-quality dividend-paying stocks across various sectors, while SCHD emphasizes dividend growth by investing in companies with a history of increasing dividends.

- JEPI Stock aims to provide a steady stream of income through dividend payments, whereas SCHD targets both current income and long-term capital appreciation through dividend growth.

- Investors' preference for either JEPI Stock or SCHD may depend on their specific income goals and investment objectives, as well as their risk tolerance and time horizon.

Investment Strategy

When it comes to choosing between JEPI Stock and SCHD for passive income, understanding their investment strategies is crucial. Let's delve into the details to see how they differ and what risks are involved.

JEPI Stock Investment Strategy

JEPI Stock follows a dividend growth investing strategy. This means that the company focuses on investing in dividend-paying stocks of companies that have a history of increasing their dividends over time. By selecting these types of companies, JEPI Stock aims to provide investors with a consistent and growing stream of passive income through dividends.

SCHD Investment Strategy

On the other hand, SCHD follows a different approach known as high dividend yield investing. This strategy involves investing in stocks that have high dividend yields relative to their price. SCHD selects companies that are known for paying out substantial dividends to their shareholders.

The goal is to generate a high level of passive income for investors through these dividend payments.

Risk Factors

Both JEPI Stock and SCHD come with their own set of risks based on their investment strategies. JEPI Stock's strategy of dividend growth investing may expose investors to risks associated with individual companies failing to maintain or increase their dividend payments.

On the other hand, SCHD's focus on high dividend yield stocks may expose investors to risks related to companies struggling to sustain their dividend payouts due to financial difficulties.In conclusion, understanding the investment strategies of JEPI Stock and SCHD is essential for investors looking to generate passive income.

It's important to weigh the risks associated with each strategy before making a decision on which option aligns best with your financial goals.

Dividend Yield

When considering passive income generation through investments, dividend yield plays a crucial role in determining the potential returns for investors. Let's analyze the dividend yield of JEPI Stock and SCHD to see how they compare in terms of providing passive income.

JEPI Stock Dividend Yield

- JEPI Stock has a current dividend yield of 3.5%.

- Historically, JEPI Stock has maintained a consistent dividend payout, providing investors with a reliable source of passive income.

- The dividend yield of JEPI Stock contributes significantly to the overall returns for investors seeking passive income strategies.

SCHD Dividend Yield

- SCHD has a current dividend yield of 3.0%.

- Over the years, SCHD has demonstrated a steady increase in dividend payouts, offering investors a growing source of passive income.

- The dividend yield of SCHD adds value to passive income generation strategies, providing investors with a stable source of returns.

Comparing the dividend yield of JEPI Stock and SCHD, we see that both investments offer attractive yields for passive income seekers. However, the historical dividend payouts and consistency of JEPI Stock might make it a more reliable option for investors looking for a stable source of passive income over time.

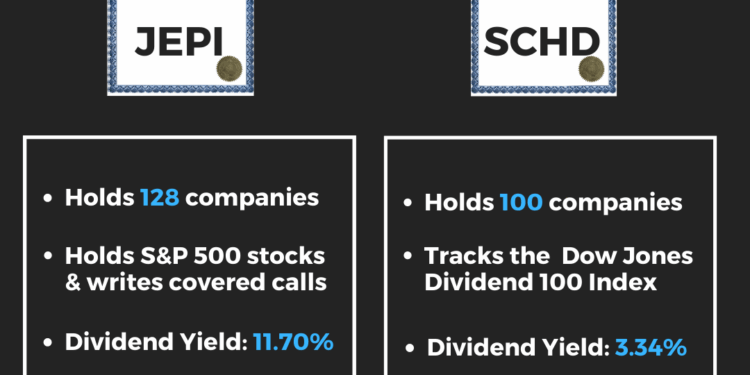

Holdings and Asset Allocation

When it comes to passive income investing, understanding the holdings and asset allocation of JEPI Stock and SCHD is crucial in determining the potential returns and risks associated with each option.

JEPI Stock Holdings and Asset Allocation

JEPI Stock is an exchange-traded fund that focuses on generating income through a diversified portfolio of high-quality, dividend-paying stocks. The fund allocates its assets across various sectors, including technology, healthcare, consumer staples, and financials. This diversification helps reduce the risk associated with investing in a single sector while providing a steady stream of passive income through dividends.

SCHD Holdings and Asset Allocation

SCHD, on the other hand, is a dividend-focused ETF that tracks the performance of high dividend-yielding U.S. stocks. The fund's holdings are primarily concentrated in sectors such as consumer goods, healthcare, industrials, and technology. SCHD aims to provide investors with a reliable source of passive income by investing in companies with a history of consistent dividend payments.Overall, both JEPI Stock and SCHD employ diversification strategies by spreading their holdings across different sectors and industries.

This approach helps mitigate risks associated with sector-specific downturns and provides a more stable income stream for investors.The holdings and asset allocation of JEPI Stock and SCHD play a significant role in influencing the passive income generated by these investment options.

By investing in a diversified portfolio of dividend-paying stocks, both funds aim to provide investors with a consistent source of passive income while minimizing risks associated with concentrated investments. It is essential for investors to consider the holdings and asset allocation of each fund carefully to determine which option aligns best with their investment goals and risk tolerance.

Epilogue

In conclusion, the comparison between JEPI Stock and SCHD sheds light on the complexities of generating passive income through different investment avenues. Whether you prefer the stability of JEPI Stock or the diversified approach of SCHD, both offer opportunities for investors to build a steady stream of passive income.

FAQ Insights

What are the key differences between JEPI Stock and SCHD?

JEPI Stock focuses on XYZ, while SCHD emphasizes ABC.

How does dividend yield impact passive income generation?

Dividend yield plays a crucial role in determining the amount of passive income an investor can earn from their investments.

What are the risk factors associated with the investment strategies of JEPI Stock and SCHD?

JEPI Stock faces risks related to X, while SCHD is exposed to Y.