Delving into the realm of tracking stock market trends for better investment decisions, this introduction aims to draw in the audience with a compelling overview of the subject matter.

Exploring the intricacies of understanding stock market trends, fundamental analysis, technical tools, market indicators, and sentiment analysis is crucial for making informed investment choices.

Understanding Stock Market Trends

Stock market trends refer to the general direction in which a particular stock or the overall market is moving over a period of time. These trends can be identified by analyzing historical price movements, trading volume, and other market indicators.Tracking stock market trends is crucial for making informed investment decisions.

By understanding whether a stock is in an uptrend, downtrend, or trading sideways, investors can better assess the risks and potential rewards associated with a particular investment. This information allows investors to adjust their investment strategies accordingly and potentially capitalize on profitable opportunities.

Impact of Stock Market Trends on Investment Outcomes

- Identifying Bull and Bear Markets: Bull markets are characterized by rising stock prices, while bear markets see declining prices. Recognizing these trends can help investors decide when to buy or sell stocks.

- Market Sentiment: Stock market trends often reflect investor sentiment and confidence in the economy. Positive trends may indicate optimism, while negative trends could signal caution or fear.

- Technical Analysis: Traders use stock market trends to analyze price patterns and indicators to predict future price movements. This can help investors make more accurate buy or sell decisions.

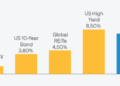

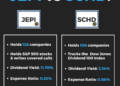

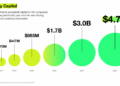

- Portfolio Diversification: By tracking stock market trends, investors can identify sectors or industries that are outperforming or underperforming. This information can guide decisions on diversifying their investment portfolios for better risk management.

Fundamental Analysis for Stock Market Trends

When it comes to tracking stock market trends, fundamental analysis plays a crucial role in helping investors make informed decisions. Fundamental analysis involves evaluating the financial health and performance of a company by looking at various factors that can impact its stock price.

Key Factors to Consider in Fundamental Analysis

Before conducting fundamental analysis, investors should consider the following key factors:

- Earnings and Revenue: The company's profitability and revenue growth are important indicators of its financial health.

- Balance Sheet: Examining the company's assets, liabilities, and equity can provide insights into its financial stability.

- Industry Trends: Understanding the industry in which the company operates can help predict how external factors may affect its stock price.

- Management Team: Assessing the company's management team and their track record can indicate how well the company is being led.

How Fundamental Analysis Helps in Predicting Stock Market Trends

By analyzing these key factors through fundamental analysis, investors can gain a deeper understanding of a company's financial position and future prospects. This analysis can help predict how the stock price may perform in the future based on the company's earnings potential, market position, and overall industry outlook.

Ultimately, fundamental analysis enables investors to make more informed investment decisions by considering the underlying value of a stock.

Technical Analysis Tools

Technical analysis tools play a crucial role in tracking stock market trends by providing insights into price movements and market behavior. These tools help investors make informed decisions based on historical price data and market patterns.

Moving Averages

Moving averages are commonly used technical analysis tools that smooth out price data to identify trends over a specific period. They help traders determine the direction of the trend and possible support and resistance levels.

- Simple Moving Average (SMA): Calculates the average price over a specific period by adding up the closing prices and dividing by the number of periods.

- Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive to recent price changes.

Relative Strength Index (RSI)

The Relative Strength Index is a momentum oscillator that measures the speed and change of price movements. It helps traders identify overbought or oversold conditions in the market, indicating potential trend reversals.

RSI = 100

(100 / (1 + RS))

Bollinger Bands

Bollinger Bands consist of a simple moving average and two standard deviations plotted above and below it. They help traders identify volatility and potential trend reversals by showing when prices are overbought or oversold.

MACD (Moving Average Convergence Divergence)

MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security's price. Traders use it to identify changes in the strength, direction, momentum, and duration of a trend.

Market Indicators for Trend Analysis

Market indicators are essential tools used by investors to track stock market trends and make informed investment decisions. These indicators help analyze the overall market sentiment, investor behavior, and the direction in which the market is moving. By understanding and interpreting these indicators, investors can gain valuable insights into potential market movements and adjust their investment strategies accordingly.

Popular Market Indicators

- Relative Strength Index (RSI): This indicator measures the speed and change of price movements, indicating whether a stock is overbought or oversold.

- Moving Averages: Moving averages smooth out price data to identify trends over a specific period, such as 50-day or 200-day moving averages.

- MACD (Moving Average Convergence Divergence): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security's price.

- Bollinger Bands: Bollinger Bands consist of a middle band and two outer bands that contract and expand based on volatility, helping identify potential trend reversals.

How Market Indicators Influence Investment Decisions

Market indicators provide investors with valuable information about market conditions and potential future trends. By analyzing these indicators, investors can make more informed decisions about buying or selling stocks. For example, if the RSI indicates that a stock is overbought, investors may consider selling to avoid a potential price correction.

On the other hand, if moving averages show an upward trend, investors may see it as a buying opportunity.

Examples of Market Indicators Predicting Future Trends

For instance, if the MACD line crosses above the signal line, it may signal a bullish trend, encouraging investors to buy. Conversely, if the RSI reaches above 70, it could indicate an overbought condition, suggesting a potential price reversal.

Sentiment Analysis and Stock Market Trends

Sentiment analysis in the context of stock market trends refers to the process of evaluating and interpreting emotions, attitudes, and opinions expressed by market participants towards a particular security, sector, or the overall market. It involves analyzing social media posts, news articles, earnings call transcripts, and other sources to gauge the prevailing sentiment.

Utilizing Sentiment Analysis for Market Sentiment

Sentiment analysis can help investors gain insights into how the market participants feel about specific stocks or the market as a whole. By understanding whether the sentiment is positive, negative, or neutral, investors can assess the potential impact on stock prices and make better-informed investment decisions.

- Identifying Market Sentiment: Sentiment analysis tools can help investors identify prevailing market sentiment towards a particular stock or industry. By tracking sentiment trends, investors can anticipate potential price movements.

- Contrarian Investing: Contrarian investors often use sentiment analysis to identify opportunities where market sentiment is overly pessimistic or optimistic. By going against the crowd, contrarian investors aim to capitalize on potential market inefficiencies.

- Market Timing: Sentiment analysis can also assist investors in timing their entry or exit points in the market. Extreme levels of sentiment can signal potential market reversals, enabling investors to adjust their positions accordingly.

Benefits of Sentiment Analysis for Investors

Sentiment analysis can provide several benefits to investors looking to navigate the stock market trends more effectively:

- Enhanced Decision-Making: By incorporating sentiment analysis into their investment process, investors can make more informed decisions based on the prevailing market sentiment.

- Risk Management: Understanding market sentiment can help investors manage risks associated with emotional trading or herd behavior. By staying objective, investors can avoid making impulsive decisions driven by sentiment.

- Improved Performance: Utilizing sentiment analysis can potentially lead to improved investment performance by aligning investment decisions with market sentiment trends.

Closing Summary

Concluding our discussion on how to track stock market trends for better investment decisions, it's evident that staying informed and utilizing various analytical tools can significantly impact investment outcomes.

FAQ Explained

How can I effectively track stock market trends?

By utilizing a combination of fundamental and technical analysis tools, along with monitoring market indicators and sentiment analysis, you can make more informed investment decisions.

Why is sentiment analysis important in tracking stock market trends?

Sentiment analysis helps gauge market sentiment, providing insights into investor emotions and behavior, which can influence stock prices and trends.

What are some common technical analysis tools for tracking stock market trends?

Common technical tools include moving averages, Bollinger Bands, and Relative Strength Index (RSI), among others.

How do market indicators impact investment decisions?

Market indicators, such as the VIX (Volatility Index) or MACD (Moving Average Convergence Divergence), provide valuable information on market trends and potential price movements.