Embark on the journey of understanding How to Choose a Shopify Capital Loan for Your Ecommerce Growth, diving into the intricacies of capital loans in the digital realm.

Detailing the factors to consider and the application process, this guide aims to equip you with the knowledge needed to make informed decisions for your business.

Understanding Shopify Capital Loans

Shopify Capital Loans are a financial solution offered by Shopify to help ecommerce businesses grow and expand. Unlike traditional loans from banks or financial institutions, Shopify Capital Loans are specifically designed for Shopify merchants, making the application and approval process faster and more convenient.

Eligibility Criteria for Shopify Capital Loans

- Active Shopify store with a history of sales

- Minimum monthly revenue threshold

- Compliance with Shopify's terms of service

Benefits of Shopify Capital Loans for Ecommerce Businesses

- Quick access to funds for inventory, marketing, or expansion

- No fixed monthly payments - repayments are based on your daily sales

- No personal guarantee required

- Flexible repayment terms

Factors to Consider When Choosing a Shopify Capital Loan

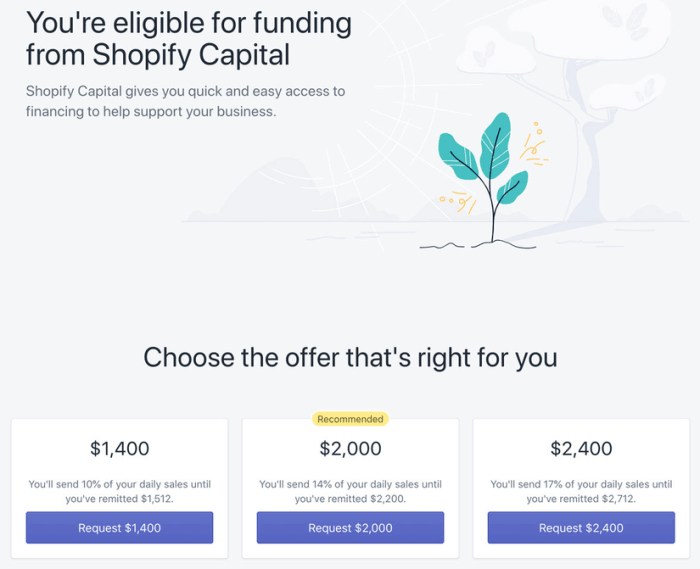

When deciding on a Shopify Capital Loan for your ecommerce growth, there are several key factors to take into consideration. It's important to understand the different types of loans available, compare interest rates, repayment terms, and fees associated with each option, as well as consider how the loan amount and duration will impact your overall ecommerce growth strategy.

Types of Shopify Capital Loans

- Merchant Cash Advance: This type of loan allows you to receive a lump sum of cash in exchange for a percentage of your daily credit card sales. Repayment is based on a fixed percentage of your daily revenue.

- Business Loan: A traditional loan with a set repayment schedule and fixed interest rate. This type of loan is ideal for larger, one-time expenses.

Interest Rates, Repayment Terms, and Fees

- Interest Rates: Shopify Capital Loans typically have competitive interest rates compared to other lenders. It's essential to compare rates and choose the option that best fits your financial situation.

- Repayment Terms: Consider the repayment terms of each loan option, including the frequency of payments and the total duration of the loan. Choose a repayment schedule that aligns with your cash flow.

- Fees: Be aware of any additional fees associated with the loan, such as origination fees or prepayment penalties. Factor these costs into your decision-making process.

Impact of Loan Amount and Duration

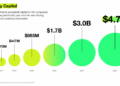

- Loan Amount: The amount of funding you receive can significantly impact your ecommerce growth. Consider your current needs and future goals when determining the loan amount.

- Duration: The duration of the loan affects your cash flow and financial obligations. Choose a loan term that allows you to comfortably repay the loan while still investing in your business.

Application Process for Shopify Capital Loans

When applying for a Shopify Capital Loan, there are specific steps you need to follow to increase your chances of approval. Understanding the application process and required documentation is crucial for a successful loan application.

Steps to Apply for a Shopify Capital Loan

- Create a Shopify account: To access Shopify Capital, you need to have an active Shopify account.

- Check eligibility: Shopify will determine if your store meets the criteria for a loan based on your sales history.

- Review loan offers: Once eligible, you will receive loan offers with different terms and amounts.

- Select the loan offer: Choose the loan offer that best suits your business needs and accept the terms.

- Complete the application: Fill out the necessary information and submit the required documents for verification.

- Receive funds: If approved, the funds will be deposited into your account within a few business days.

Documentation Required for a Shopify Capital Loan Application

- Sales history: Shopify will review your store's sales history to determine your eligibility for a loan.

- Business information: You may need to provide details about your business, such as your business name, address, and industry.

- Financial documents: Prepare financial documents like bank statements, tax returns, and income statements to support your application.

Tips to Increase Approval Chances for a Shopify Capital Loan

- Improve sales performance: Demonstrating consistent sales growth can boost your chances of approval.

- Maintain a good credit score: A higher credit score indicates lower risk for lenders, increasing your chances of approval.

- Provide accurate information: Ensure all information provided in the application is accurate and up to date.

- Prepare necessary documents: Have all required documents ready and organized to expedite the application process.

Using Shopify Capital Loans for Ecommerce Growth

When it comes to utilizing a Shopify Capital Loan to grow your ecommerce business, there are certain best practices to keep in mind. These loans can be a valuable tool for expanding your online store, but it's important to understand how to make the most of them while minimizing risks.

Best Practices for Utilizing a Shopify Capital Loan

- Invest in marketing and advertising: Use the loan to boost your online presence and attract more customers through targeted marketing campaigns.

- Expand product lines: Introduce new products or broaden your existing offerings to cater to a larger audience and increase sales.

- Improve infrastructure: Upgrade your website, enhance customer experience, and optimize logistics to streamline operations and scale your business efficiently.

Examples of Successful Ecommerce Growth Strategies with Shopify Capital Loans

Many ecommerce businesses have successfully grown with the help of Shopify Capital Loans. For instance, a clothing retailer used the loan to invest in influencer collaborations, resulting in a significant increase in brand visibility and sales. Another online store utilized the funds to expand into international markets, tapping into new customer segments and boosting revenue.

Risks Involved in Using a Shopify Capital Loan and How to Mitigate Them

- High-interest rates: Be mindful of the interest rates associated with the loan and ensure that the returns from your growth strategies outweigh the cost of borrowing.

- Overleveraging: Avoid taking on more debt than your business can comfortably repay, as it could lead to financial strain and potential default.

- Market fluctuations: Consider the impact of market changes on your business growth plans and have contingency measures in place to adapt to unforeseen circumstances.

Final Wrap-Up

Wrapping up the discussion on choosing a Shopify Capital Loan for Ecommerce Growth, we've explored the essentials to help you navigate this financial avenue with confidence and strategy.

FAQ Summary

What are the eligibility criteria for a Shopify Capital Loan?

To be eligible, you typically need to have a certain sales volume on Shopify and meet other specified requirements set by Shopify Capital.

What types of Shopify Capital Loans are available?

Shopify offers different loan options, such as merchant cash advances and business loans, tailored to meet varying business needs.

How can I increase my chances of approval for a Shopify Capital Loan?

Maintaining a healthy sales record, providing accurate documentation, and having a clear growth strategy can improve your approval odds.