As How Healthcare Stocks Like Narayana Are Changing Investment Portfolios takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

In this article, we delve into the transformative impact of healthcare stocks, particularly focusing on Narayana's role and how they are reshaping investment portfolios.

Overview of Healthcare Stocks Like Narayana

Healthcare stocks represent shares of companies operating within the healthcare industry, including pharmaceuticals, biotechnology, medical devices, hospitals, and healthcare providers. These stocks are influenced by factors such as regulatory changes, technological advancements, and demographic trends.Narayana Health, a prominent player in the healthcare industry, is known for its chain of hospitals offering affordable and quality medical services in India and abroad.

The company's innovative approach to healthcare delivery has positioned it as a leader in the industry, attracting investors looking to capitalize on the growing demand for healthcare services.

Significance of Narayana in the Healthcare Industry

Narayana's focus on providing high-quality, affordable healthcare has not only benefited patients but also investors seeking exposure to the healthcare sector. The company's strong financial performance, coupled with its expansion strategies, has made it an attractive investment option in the healthcare space.

- Narayana's unique business model emphasizes cost-effective healthcare solutions, making it a standout player in the industry.

- The company's consistent growth and profitability have garnered the attention of investors looking for sustainable returns in the healthcare sector.

- Narayana's international presence and collaborations further enhance its position as a key player in the global healthcare market.

Differences Between Healthcare Stocks and Other Investments

Investing in healthcare stocks differs from other types of investments due to the specific nature of the industry and its unique considerations.

- Healthcare stocks are influenced by regulatory changes, drug approvals, and healthcare policy shifts, making them more volatile compared to other sectors.

- The demand for healthcare services is relatively stable, providing a defensive quality to healthcare stocks during economic downturns.

- Healthcare companies often require significant research and development investments, leading to higher capital requirements and potential risks.

Factors Influencing Healthcare Stocks Performance

When it comes to investing in healthcare stocks, there are several key factors that can significantly influence their performance. Understanding these factors is crucial for making informed investment decisions in this sector.

Regulations in Healthcare Stock Investments

Regulations play a critical role in shaping the performance of healthcare stocks. The healthcare industry is heavily regulated, with laws and policies that can impact everything from drug approvals to reimbursement rates. Investors need to closely monitor regulatory changes and compliance issues that may affect the financial health of healthcare companies.

Technological Advancements in Healthcare

Technological advancements have a profound impact on the value of healthcare stocks. Companies that innovate and adopt cutting-edge technologies are more likely to experience growth and success in the market. For example, the rise of telemedicine, artificial intelligence in diagnostics, and personalized medicine have all contributed to the performance of healthcare stocks in recent years.

Narayana's Contribution to Changing Investment Portfolios

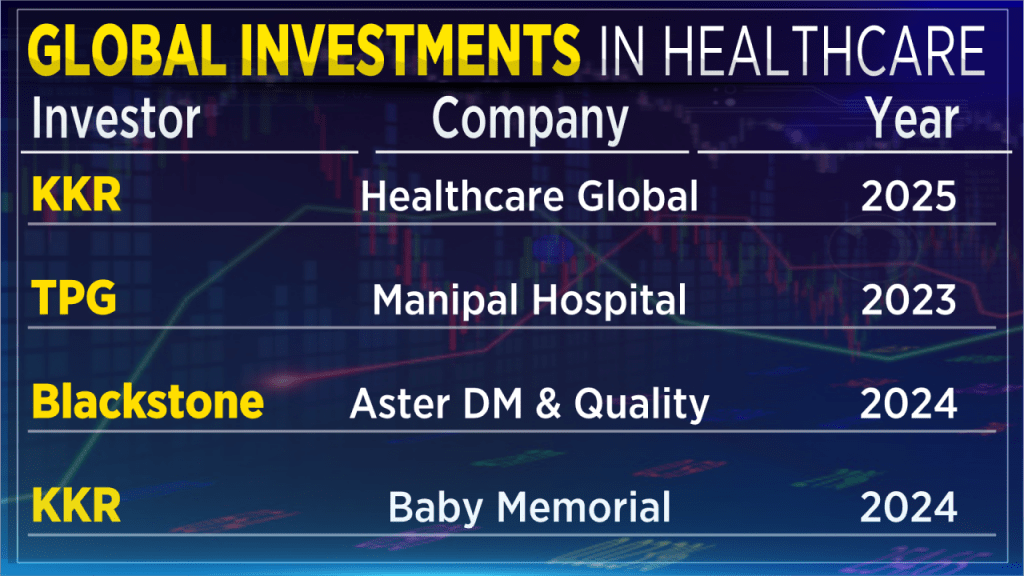

Investing in healthcare stocks like Narayana has become increasingly popular among investors looking to diversify their portfolios and capitalize on the growth potential of the healthcare sector. Narayana's unique business model and impressive growth trajectory have played a significant role in reshaping investment portfolios and influencing investor decisions.

Impact of Narayana's Growth on Investment Portfolios

Narayana's consistent growth and success in the healthcare industry have attracted the attention of investors seeking exposure to this high-growth sector. The company's innovative approaches to healthcare delivery, cost-effective services, and expansion into new markets have all contributed to its rising stock value.

As a result, including Narayana stocks in an investment portfolio can provide investors with exposure to a promising healthcare player with strong growth potential.

Impact of Narayana's Business Model on Investors

Narayana's business model, which focuses on providing affordable and quality healthcare services, has resonated with investors looking for companies with a social impact. By investing in Narayana, investors not only stand to benefit financially from the company's growth but also contribute to improving access to healthcare for underserved populations.

This dual impact of financial returns and social responsibility makes Narayana an attractive investment option for many investors.

Diversification Benefits of Including Narayana Stocks in a Portfolio

Adding Narayana stocks to an investment portfolio can enhance diversification by providing exposure to the healthcare sector, which tends to have low correlation with other industries. The healthcare sector is known for its defensive characteristics, as demand for healthcare services remains relatively stable regardless of economic conditions.

Therefore, including Narayana stocks can help reduce overall portfolio risk and potentially improve returns by adding a unique asset class to the mix.

Risks and Opportunities in Investing in Healthcare Stocks

Investing in healthcare stocks like Narayana can offer significant opportunities for growth and profitability, but it also comes with its fair share of risks that investors need to consider.

Risks Associated with Investing in Healthcare Stocks

- Regulatory Risks: Changes in healthcare regulations can directly impact the operations and profitability of healthcare companies like Narayana. Investors need to stay updated on regulatory changes.

- Market Competition: The healthcare sector is highly competitive, with new players entering the market frequently. This can affect the market share and revenue of established companies like Narayana.

- Clinical Trials and R&D: Healthcare companies heavily rely on successful clinical trials and research and development (R&D) for new treatments. Failures in these areas can lead to significant financial losses.

Opportunities for Growth and Sustainability in the Healthcare Sector

- Technological Advancements: The integration of technology in healthcare services can lead to improved efficiency, patient care, and cost savings. Companies like Narayana that embrace technological advancements can gain a competitive edge.

- Global Expansion: Healthcare companies expanding into new markets can tap into a larger patient base and revenue streams. International expansion can drive growth and diversification for companies like Narayana.

- Aging Population: The aging population globally creates a growing demand for healthcare services and treatments. Healthcare companies catering to this demographic can capitalize on this trend for sustained growth.

Strategies for Mitigating Risks when Investing in Healthcare Stocks

- Diversification: Spread investments across multiple healthcare stocks to reduce the impact of any single company's performance on your portfolio.

- Due Diligence: Conduct thorough research on healthcare companies, their financial health, management team, and growth prospects before investing.

- Long-Term Perspective: Healthcare investments can be volatile in the short term, so adopting a long-term investment approach can help ride out market fluctuations.

Final Thoughts

In conclusion, the discussion around How Healthcare Stocks Like Narayana Are Changing Investment Portfolios sheds light on the evolving landscape of investment opportunities within the healthcare sector. As investors navigate these changes, it becomes crucial to adapt and capitalize on the shifting dynamics for long-term financial growth.

Answers to Common Questions

What are healthcare stocks?

Healthcare stocks represent shares of companies operating in the healthcare sector, including pharmaceuticals, biotechnology, hospitals, and medical equipment.

How does Narayana contribute to changing investment portfolios?

Narayana's growth influences investment portfolios by offering exposure to the healthcare industry, diversifying investment options, and potentially providing long-term growth opportunities.

What are the risks associated with investing in healthcare stocks?

Risks include regulatory changes, clinical trial failures, and market volatility. It's essential for investors to conduct thorough research and risk analysis before investing.