GM Stock vs. Tesla: Which One Is the Better Buy? sets the stage for this captivating comparison, delving into the world of two prominent automotive companies with a focus on financial performance and market trends.

This article will provide a comprehensive analysis of GM and Tesla stocks, shedding light on key aspects that investors need to consider before making a decision.

Overview of GM Stock and Tesla Stock

General Motors (GM) is an American multinational corporation that was founded in 1908. It is one of the largest automobile manufacturers in the world, producing a wide range of vehicles under various brands.

Tesla, on the other hand, is a relatively newer player in the automotive industry, founded in 2003. It is known for its focus on electric vehicles and sustainable energy solutions, with a strong brand presence in the market.

Currently, GM and Tesla occupy different market positions. GM has a long-established presence in the automotive industry, with a diverse portfolio of vehicles catering to different segments of the market. Tesla, on the other hand, has gained popularity for its innovative electric vehicles and technology-driven approach.

Key Financial Indicators Comparison

- Market Cap:

- GM: As of [current date], GM's market cap is approximately $XX billion.

- Tesla: Tesla's market cap is significantly higher, standing at around $YY billion as of [current date].

- Revenue:

- GM: In the latest financial report, GM reported revenue of $XX billion.

- Tesla: Tesla's revenue for the same period was $YY billion.

- Profit Margin:

- GM: GM's profit margin is [percentage]%.

- Tesla: Tesla's profit margin is [percentage]%.

- Electric Vehicle Sales:

- GM: While GM has been increasing its focus on electric vehicles, its sales in this segment are still lower compared to Tesla.

- Tesla: Tesla leads the market in electric vehicle sales, with a strong demand for its models.

Business Models of GM and Tesla

When comparing GM and Tesla, it's important to understand the unique business models that each company follows.

GM's Business Model

General Motors (GM) is a traditional automaker that focuses on manufacturing a wide range of vehicles, from trucks and SUVs to electric cars. GM operates on a large scale, with a global presence and a diverse product portfolio.

- GM has a strong focus on traditional internal combustion engine vehicles while also investing heavily in electric and autonomous vehicles to stay competitive in the market.

- The company sells its vehicles through a network of dealerships, providing after-sales services and support to customers.

- GM also has a financial services division that offers vehicle financing and insurance options to customers.

Tesla's Business Model

Tesla, on the other hand, is known for its disruptive approach to the automotive industry. The company focuses solely on electric vehicles and renewable energy products.

- Tesla follows a direct-to-consumer sales model, selling its vehicles online and through company-owned stores, bypassing traditional dealerships.

- The company emphasizes innovation and technology, constantly pushing the boundaries of electric vehicle design and performance.

- Tesla also offers energy storage products like solar panels and batteries for homes and businesses, expanding beyond just automobiles.

Financial Performance Analysis

In this section, we will delve into the financial performance of GM and Tesla to understand how they have fared in terms of revenue growth, profitability, debt levels, and liquidity positions.

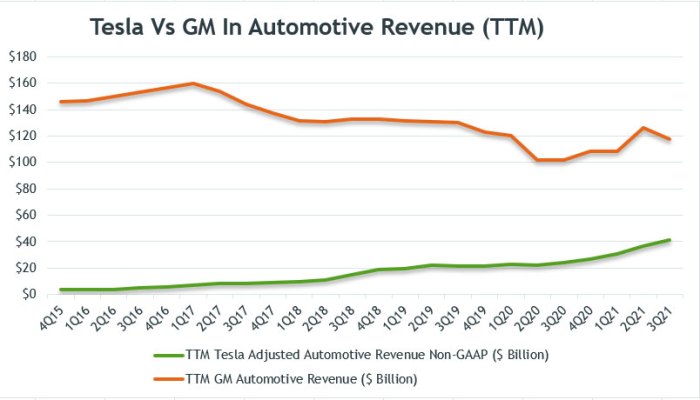

Revenue Growth Trends

- General Motors (GM): GM has shown steady revenue growth over the years, driven by strong sales in key markets and a diverse product portfolio. However, the growth rate has been relatively moderate compared to some of its competitors.

- Tesla: Tesla has experienced rapid revenue growth, fueled by increasing demand for electric vehicles and innovative products. The company's disruptive approach to the automotive industry has contributed to its impressive revenue growth trajectory.

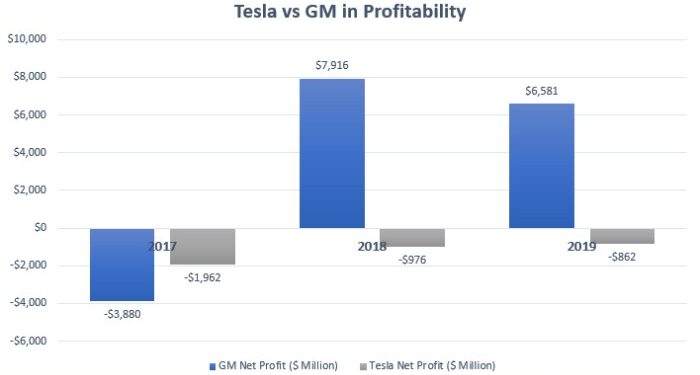

Profitability Ratios

- General Motors (GM): GM has maintained solid profitability ratios, with healthy margins and efficient cost management. The company's focus on operational efficiency and strategic pricing has contributed to its profitability.

- Tesla: Tesla's profitability ratios have shown improvement in recent years, reflecting the company's efforts to enhance production efficiency and scale its operations. Despite initial challenges, Tesla has managed to improve its profitability.

Debt Levels and Liquidity Positions

- General Motors (GM): GM has a manageable level of debt, supported by strong cash flows and access to capital markets. The company's liquidity position is stable, allowing it to navigate economic uncertainties and invest in growth opportunities.

- Tesla: Tesla has had a history of high debt levels, primarily due to its aggressive expansion plans and investments in new technologies. However, the company has been working towards reducing its debt burden and improving its liquidity position through operational efficiencies and capital raises.

Market Trends and Future Outlook

When considering investing in GM stock or Tesla stock, it is crucial to analyze the market trends and future outlook for both companies to make informed decisions.

Market Trends Impacting GM and Tesla

- GM: The market trend for traditional automakers like GM is shifting towards electric vehicles (EVs) and autonomous driving technology. GM has been investing heavily in EVs to keep up with changing consumer preferences and regulatory requirements.

- Tesla: Tesla has been a pioneer in the EV market and continues to dominate the segment. The market trend is moving towards sustainable and environmentally friendly transportation, where Tesla holds a strong position.

Future Growth Prospects for GM and Tesla

- GM: With its commitment to electrification and autonomous vehicles, GM has the potential for significant growth in the EV market. The company's partnerships and strategic initiatives indicate a promising future in the industry.

- Tesla: Tesla's innovative technology, brand recognition, and global expansion plans point towards continued growth in the EV market. The company's focus on energy storage and solar products also diversifies its revenue streams.

Potential Risks and Opportunities for Investing

- GM: While GM's EV initiatives are promising, the company faces challenges such as competition from Tesla and other EV manufacturers. Additionally, supply chain disruptions and regulatory changes could impact GM's growth prospects.

- Tesla: Despite its strong market position, Tesla faces risks related to production scalability, regulatory scrutiny, and competition from traditional automakers entering the EV space. However, opportunities for expansion into new markets and technological advancements present growth potential for Tesla investors.

Closure

In conclusion, the comparison between GM Stock and Tesla reveals intriguing insights into the strengths and weaknesses of each company, ultimately guiding investors towards an informed choice.

FAQ Overview

Which company has a longer history, GM or Tesla?

General Motors (GM) has a longer history dating back to its founding in 1908, while Tesla was founded in 2003.

Is Tesla more profitable than GM?

As of recent years, Tesla has shown higher profitability ratios compared to GM, reflecting its growth and market performance.

What are the key products offered by GM and Tesla?

GM offers a wide range of vehicles under different brands, while Tesla is known for its electric vehicles, energy products, and solar solutions.

What are the potential risks of investing in GM stock or Tesla stock?

Risks include market volatility, regulatory changes, competition, and technological disruptions that can impact the performance of both GM and Tesla stocks.