Embarking on the journey of Deepak Nitrite Share Forecast for Long-Term Investors, this introductory paragraph aims to intrigue and inform the readers, paving the way for a comprehensive exploration of the topic.

The subsequent section will delve into the rich history and offerings of Deepak Nitrite, shedding light on its market standing and reputation.

Overview of Deepak Nitrite

Deepak Nitrite is a leading chemical manufacturing company with a rich history dating back to 1970. The company has grown significantly over the years to become a key player in the chemical industry in India.

Key Products and Services

- Deepak Nitrite offers a wide range of products including basic chemicals, fine and specialty chemicals, and performance products.

- The company is known for its expertise in manufacturing chemicals used in various industries such as agrochemicals, pharmaceuticals, plastics, and rubber.

- Deepak Nitrite also provides custom manufacturing solutions to meet the specific needs of its customers.

Market Presence and Reputation

- Deepak Nitrite has established a strong presence in the domestic market and has also expanded its operations globally.

- The company is known for its high-quality products, innovation, and commitment to sustainability and environmental responsibility.

- Deepak Nitrite has built a solid reputation for reliability and customer satisfaction, making it a trusted partner for many businesses in the chemical industry.

Factors Influencing Deepak Nitrite's Share Forecast

When it comes to predicting the future performance of Deepak Nitrite's shares, there are several key factors to consider. These factors include the historical performance of the company's shares, industry trends, and recent developments related to Deepak Nitrite.

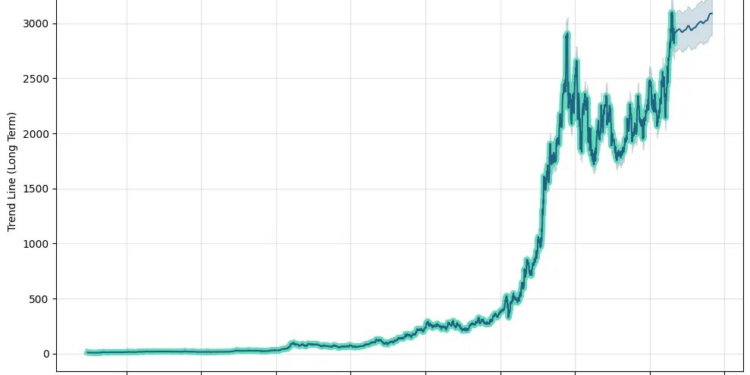

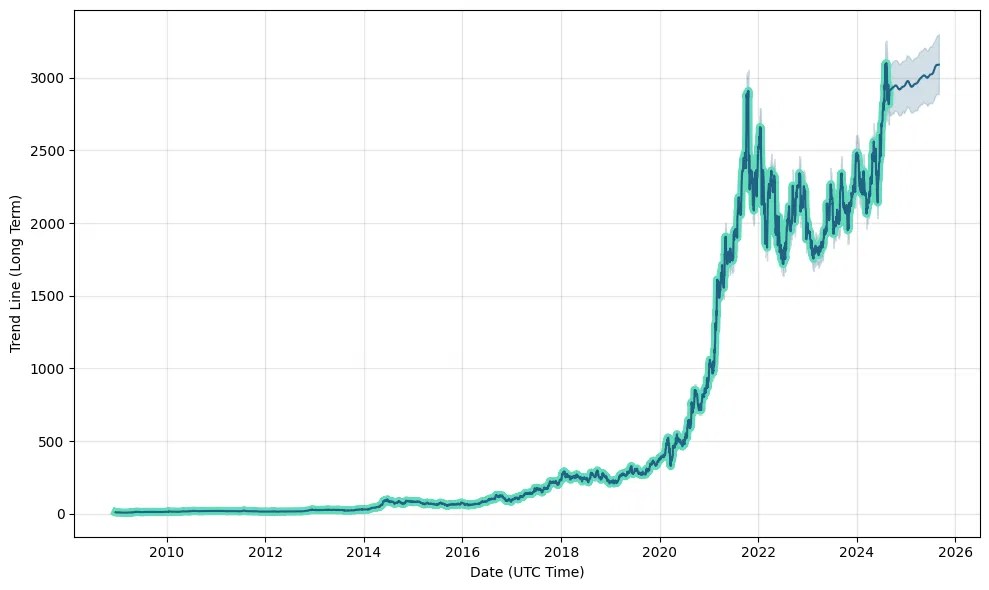

Historical Performance of Deepak Nitrite's Shares

Deepak Nitrite has shown consistent growth in its share price over the years. The company has a track record of delivering strong financial results and expanding its product portfolio. Investors often look at past performance to gauge future potential, and in the case of Deepak Nitrite, the historical data suggests a positive outlook for the company's shares.

Industry Trends Impact on Deepak Nitrite's Share Forecast

The chemical industry, where Deepak Nitrite operates, is subject to various trends and factors that can influence the company's share price. Factors such as raw material prices, demand for chemicals, regulatory changes, and competition can all impact Deepak Nitrite's financial performance and, consequently, its share forecast.

Keeping an eye on industry trends is crucial for investors looking to make informed decisions about Deepak Nitrite's shares.

Recent Developments and News related to Deepak Nitrite

Recent developments and news related to Deepak Nitrite can also play a significant role in shaping the company's share forecast. This could include new product launches, acquisitions, partnerships, regulatory approvals, or any other events that might impact the company's financial health and market position.

Staying updated on such developments is essential for investors looking to anticipate potential changes in Deepak Nitrite's share price.

Long-term Investment Potential

Investing in Deepak Nitrite for the long term can be a strategic move for investors looking for sustainable growth and stability in their portfolio. Let's delve into the factors that make Deepak Nitrite an attractive option for long-term investment.

Comparative Performance with Competitors

When compared to its competitors in the chemical industry, Deepak Nitrite has shown consistent growth and profitability. The company's strong focus on innovation and diversification has allowed it to stay ahead of the curve and maintain a competitive edge in the market.

- Deepak Nitrite's revenue growth has outpaced that of its competitors, showcasing its ability to capture market share and expand its customer base.

- The company's profit margins have remained stable, indicating efficient cost management and operational excellence compared to industry peers.

- Deepak Nitrite's stock performance has been impressive, with steady appreciation over the years, offering long-term investors a promising return on investment.

Financial Health and Stability

Deepak Nitrite boasts a strong balance sheet and financial stability, making it a reliable choice for long-term investors seeking consistent returns and reduced risk exposure.

With a healthy debt-to-equity ratio and ample cash reserves, Deepak Nitrite is well-positioned to weather economic downturns and capitalize on growth opportunities.

Growth Prospects and Strategic Initiatives

The company's robust growth prospects and strategic initiatives further enhance its long-term investment potential, signaling a promising outlook for investors looking to capitalize on future opportunities.

- Deepak Nitrite's focus on expanding its product portfolio and entering new markets bodes well for sustained growth and revenue diversification.

- The company's investments in research and development underscore its commitment to innovation and staying ahead of market trends, ensuring long-term competitiveness.

- Strategic partnerships and collaborations with industry leaders position Deepak Nitrite for continued success and market leadership in the chemical sector.

Risks and Challenges

In every investment opportunity, there are inherent risks and challenges that could potentially impact the forecast for Deepak Nitrite's shares. These risks can come from both external factors such as economic conditions and regulatory changes, as well as internal factors like management decisions.

External Factors

- The global economic landscape: Any significant changes in the global economy, such as recessions or economic downturns, could affect the demand for Deepak Nitrite's products and subsequently impact their share prices.

- Regulatory changes: Shifts in regulations related to the chemical industry or environmental policies could have a direct impact on Deepak Nitrite's operations and profitability, influencing investor sentiment towards the company.

- Market competition: Intense competition within the chemical industry could lead to pricing pressures and market share challenges for Deepak Nitrite, affecting their revenue and ultimately their share performance.

Internal Factors

- Management decisions: Strategic choices made by Deepak Nitrite's management team, such as expansion plans, acquisitions, or cost-cutting measures, could either positively or negatively impact the company's financial health and share prices.

- Operational risks: Any operational disruptions, supply chain issues, or production delays within Deepak Nitrite's facilities could hinder their ability to meet market demand and result in decreased investor confidence.

- Financial performance: Fluctuations in Deepak Nitrite's financial performance, such as revenue growth, profit margins, or debt levels, could influence investor perceptions of the company's stability and future prospects.

Conclusive Thoughts

Concluding our discussion on Deepak Nitrite Share Forecast for Long-Term Investors, this final paragraph encapsulates the key points and leaves readers with valuable insights to ponder.

User Queries

What sets Deepak Nitrite apart from its competitors?

Deepak Nitrite's focus on innovation and consistent growth strategies differentiate it from competitors, making it a strong contender in the market.

How does Deepak Nitrite ensure financial stability for long-term investors?

Deepak Nitrite maintains a robust financial structure, backed by prudent financial management practices and strategic investments to secure long-term investor interests.

What potential risks should long-term investors consider when investing in Deepak Nitrite?

Long-term investors should be wary of external factors like market volatility and regulatory changes, which could impact Deepak Nitrite's share forecast.